2022 Standard Mileage Rate Change

Just yesterday, the IRS updated the Standard Mileage Rate of 2022 for the second half of 2022 meaning that if you use your vehicle for work, you can deduct an additional 4¢ per mile. You may be thinking that 4¢ per mile when gas is at its highest price in decades is nothing, but really there is more to unfold from this. Lets unpack this a little and go over how this will impact you come your 2022 tax return come next April.

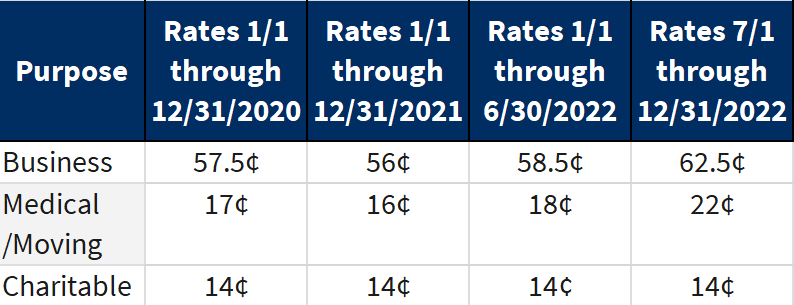

Every year the IRS updates their Standard Mileage rate for both business and medical/moving miles. In late 2021, the IRS updated the rates to be 58.5¢ per business mile and 18¢ per medical/moving mile, but with the recent uptick in the price of gasoline, the IRS has revised those rates mid-year by 4¢ each. The last time that this was done was 2011. Miles driven for charities are set at 14¢ per mile by statute.

Just today, we received a call from a client who received a desk audit notice (the worst kind of notice) from the IRS requesting their mileage log to substantiate their automotive expense taken for 2019, 2020, and 2021 tax returns. The IRS requires a written log detailing the date of your business trip, the total number of miles, and the purpose of such visit. If the client is unable to substantiate their mileage for these three years, they are looking at not only a hefty tax adjustment, but interest and penalties going back to when their 2019 tax return was due. For tax purposes, having a mileage log is about as important as having good insurance; you hate to do it when you don’t need it, but when you do it saves you big time.

We have a template of what is required on our website that you can use to help track these details. As an alternative, there are several apps that you can download to your phone that will automatically track all of your mileage by date and location. Personally, I have tried a few of these and see how well they work and I was a little unimpressed when accounting for the monthly fee but they certainly were easier than filling out everything by hand (I would definitely sort through the trips on a regular basis to keep things fresh). Like everything, the best method for you is the one that you can stick with.